Davenport Balanced Income Fund (DBALX)

The Virtues of Vanilla

October 2025

Who likes vanilla? If we’re talking about ice cream, vanilla is among the world’s most-loved flavors. If we’re talking about investments, so-called “plain vanilla” securities often get a “bah, humbug” reaction. Maybe they shouldn’t.

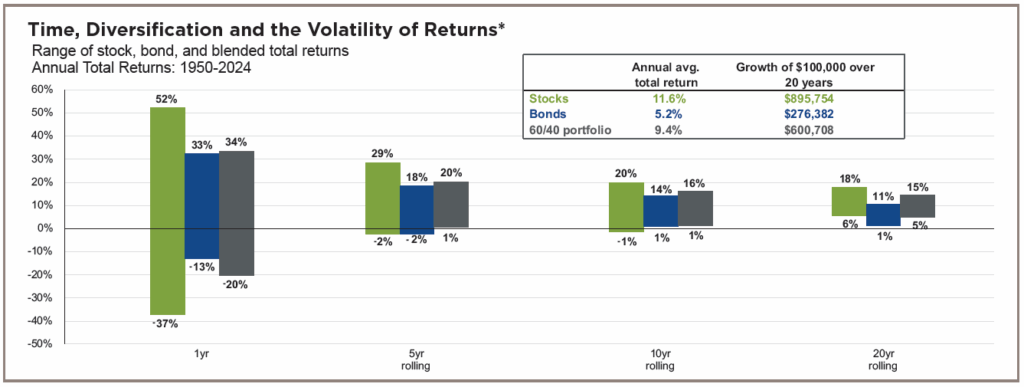

Using the graph to the right, we can make a case for a humble, plain-vanilla investment strategy: a portfolio with roughly 60% invested in stocks and 40% in bonds. Such a 60/40 portfolio (shown in the gray bars of the accompanying chart) has generated approximately a 9% compounded annual return for the past 74 years, and hasn’t endured a negative return in any 5-year period since 1950.

The Davenport Balanced Income Fund (DBALX) is built on this 60/40 chassis, with approximately 60% of the strategy invested in the stocks owned by our Value & Income Fund and 40% of the strategy invested by Davenport’s fixed-income team with a high-quality, intermediate-term bias. The goal of DBALX is to deliver competitive returns, while exhibiting a below-average level of volatility. We believe the second part of that equation is almost as important as the first part, insofar as extreme volatility often causes investors to become fearful at the most inopportune times. We seek to avoid “Rocky Roads.” With a smoother, less-volatile ride, investors may be more apt to stay invested, enabling the magic of compounding to do its work.

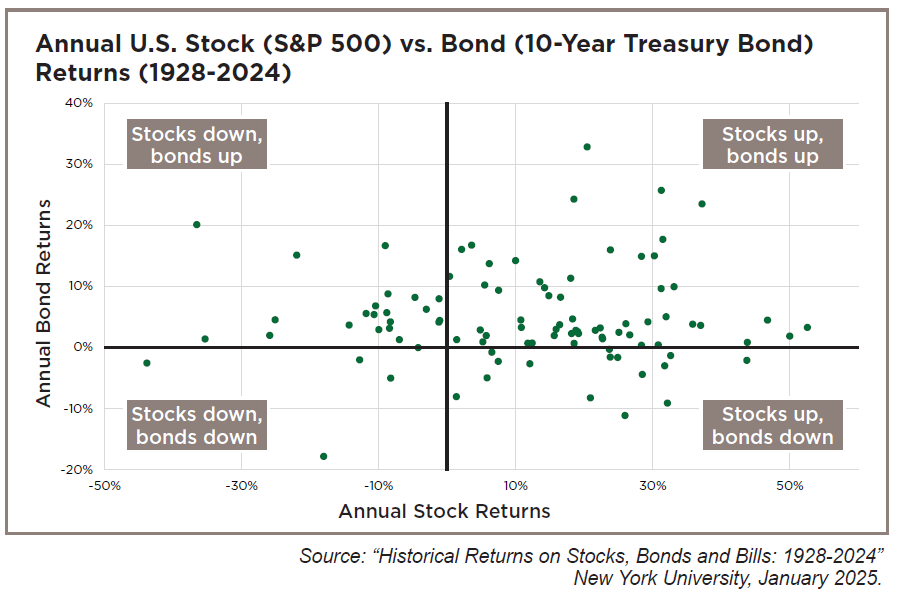

Such a Fund may be particularly timely, insofar as the Federal Reserve’s recent interest rate cutting cycle could be beneficial for both fixed-income and equity investments. The graph to the right shows how a 60/40 portfolio has performed for nearly a century: While stocks and bonds frequently increase in value, rarely do they both decline at the same time (only four years since 1928).

Let’s get under the hood of our Balanced Fund. On the fixed-income side of the ledger, our strategy’s calling card is high quality. Instead of stretching for yield in highly leveraged businesses, we’re seeking to “clip coupons” from well-regarded issuers, including Meta, Charles Schwab, HCA, and Occidental Petroleum. We also sprinkle in Treasury and federal agency bonds, both for their quality as well as liquidity. All of the holdings are “investment grade” (at least a triple-B credit rating). In total, the Fund owns nearly 30 bonds, providing an ample level of diversification across issuers and maturities.

On the equity side of the Fund, the highly recognizable roster of companies we own gives us a degree of comfort through the market’s inevitable ups and downs. These include household names such as Chevron, Johnson & Johnson, Anheuser Busch, JPMorgan, and Norfolk Southern. The Fund owns approximately 45 stocks, again providing a helpful level of diversification.

When we combine the interest income of the bond portion of the Fund with the dividend yield of the Fund’s equity holdings, the strategy supplies a generous total yield. Among the equities, all but five of our holdings have raised their dividend this year (among the exceptions are several companies that have never paid a dividend, such as Berkshire Hathaway and Markel). The average year-over-year dividend increase among our Fund companies is 8%. Getting an 8% “pay raise” for simply continuing to own companies we already like strikes us as the cherry on top of this vanilla sundae.

Securities and Advisory Services offered through Davenport & Company LLC Member: NYSE | FINRA | SIPC

*Source: Bloomberg, FactSet, Federal Reserve, Standard & Poor’s, Strategas/Ibbotson, J.P. Morgan Asset Management. Returns shown are based on calendar year returns from 1950 to 2024. Stocks: S&P 500; Bonds: Strategas/Ibbotson for periods prior to 1976 and the Bloomberg U.S. Aggregate thereafter. Growth of $100,000 is based on annual average total returns from 1950 to 2024. J.P. Morgan Asset Management, “Guide to the Markets – U.S.” Data are as of September 30, 2025.

Important Disclosures

The statements and opinions expressed in this article are those of the authors as of the date of the article, are subject to rapid change as economic and market conditions dictate, and do not necessarily represent the views of Davenport & Company LLC. This article does not constitute investment advice, is not predictive of future performance, and should not be construed as an offer to sell or a solicitation to buy any security or make an offer where otherwise unlawful. Investing in securities carries risk including the possible loss of principal. Individual circumstances vary. Diversification and asset allocation does not ensure a profit or guarantee protection against a loss. Davenport and Company LLC and JP Morgan Asset Management are not affiliated. The Percent of Net Assets for fund holdings are as followed: Meta = 1.92%, Charles Schwab = 1.41%, HCA = 1.35%, Occidental Petroleum = 1.32%, Chevron = 1.84%, Johnson & Jonson = 1.96%, Anheuser Busch = 1.66%, JPMorgan = 1.58%, Norfolk Southern = 1.51%, Berkshire Hathaway = 1.15%, Markel = 1.18%.

Performance shown is historical and is no guarantee of future results. An index is not available for direct investment; therefore its performance does not reflect the expenses, fees and taxes generally paid with the active management of an actual portfolio. The S&P 500® is widely regarded as the best single gauge of large-cap U.S. equities. The index includes 500 leading companies and covers approximately 80% of available market capitalization. The index is a product of S&P Dow Jones Indices LLC, a division of S&P Global, or its affiliates (“SPDJI”). Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC, a division of S&P Global (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”). The Bloomberg US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, fixed rate agency MBS, ABS and CMBS (agency and non-agency). BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Bloomberg does not approve or endorse this material or guarantee the accuracy or completeness of any information herein, nor does Bloomberg make any warranty, express or implied, as to the results to be obtained therefrom, and, to the maximum extent allowed by law, Bloomberg shall not have any liability or responsibility for injury or damages arising in connection therewith.

Risk Considerations: There is no guarantee that a company will continue to pay dividends. Investments in debt instruments may decline in value as the result of declines in the credit quality of the issuer, borrower, counterparty, or other entity responsible for payment, underlying collateral, or changes in economic, political, issuer-specific, or other conditions. Certain types of debt instruments can be more sensitive to these factors and therefore more volatile. In addition, debt instruments entail interest rate risk (as interest rates rise, prices usually fall), therefore the Fund’s share price may decline during rising rates. Funds that consist of debt instruments with longer durations are generally more sensitive to a rise in interest rates than those with shorter durations. Investments in below investment grade quality debt instruments can be more volatile and have greater risk of default, or already be in default, than higher-quality debt instruments. Investments in municipal instruments can be volatile and significantly affected.

The fund may not achieve its objective and/or you could lose money on your investment in the fund. Stock markets and investments in individual stocks are volatile and can decline significantly in response to market, foreign securities, small company, exchange traded fund, investment style and management risks. Small and mid cap company stocks may be more volatile than stocks of larger, more established companies. Please see the prospectus for further information on these and other risk considerations. Investors should consider the Fund’s investment objectives, risks, charges, and expenses carefully before investing. The Fund’s prospectus and summary prospectus contain this and other important information, should be read carefully before investing or sending money, and may be obtained from your Financial Advisor, www.investdavenport.com, or by calling (800) 846-6666. Distributed by Ultimus Fund Distributors, LLC. (Member FINRA)

An investor cannot invest in these indices and their returns are not indicative of the performance of any specific investment.

© 2025 Davenport & Company LLC – All Rights Reserved.